In the latest episode of the Institute’s podcast, luxury real estate professionals Tami Simms and Jack Miller, along with Deborah Worth – strategic analyst and author of the Institute’s monthly Luxury Market Reports – break down 2025 market expectations, review the first quarter’s performance, and analyze how macroeconomic forces like interest rates, stock market volatility, and tariffs are shaping buyer and seller behavior in the luxury segment.

Here are a few highlights of the topics discussed:

2025 Market Expectations vs. Q1 Reality

The year began on a wave of optimism, building on a strong finish to 2024 and fueled by interest rate cuts in both the U.S. and Canada. Experts anticipated a dynamic but more balanced luxury market in 2025; driven by increased inventory, a renewed sense of seller confidence, and continued pent-up buyer demand after years of historically low supply.

(Suggested Reading : Luxury Real Estate Shows Promising Trends for 2025)

A major wealth shift was also underway: the much-anticipated “great wealth transfer.” Millennials and Gen Xers, benefiting from intergenerational financial transfers, are becoming more active in the luxury real estate space, contributing to market activity in both urban and second-home markets.

In January 2025, the market responded accordingly. For instance, the overall inventory for single-family homes rose by 22% compared to January 2024, while new inventory surged 33%. These conditions translated into a 17.8% increase in sales year-over-year, indicating that buyers were ready to respond to improved inventory options.

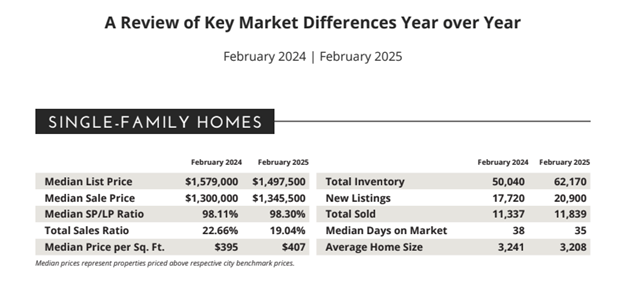

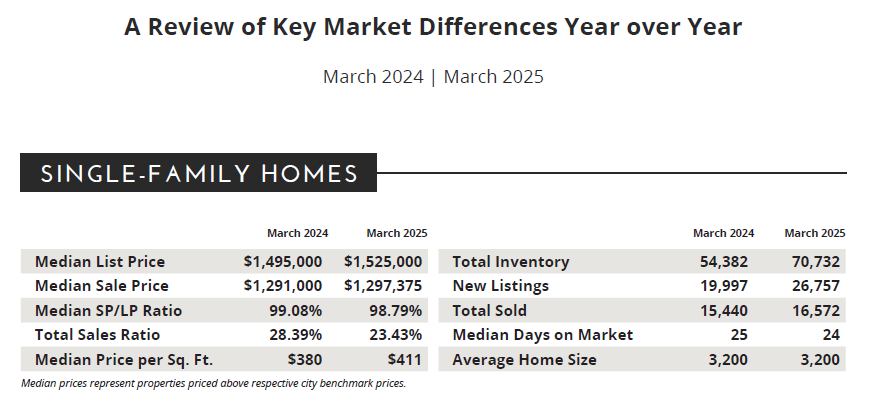

(If you want to take a snap shot – look at the data in February’s and March’s Single-family Reports – see below)

However, February told a different story. Although total inventory climb-up by 24% year-over-year, the rate of new listings slowed to 17.9%, a notable drop from January’s 33%. Meanwhile, sales growth cooled significantly, rising just 4.5% year-over-year.

While activity remained positive, the momentum seen in January had clearly tempered in February, suggesting early signs of market hesitancy. Expectations are that the market will see similar trends in March (at the time of the podcast March data was not available).

Key Market Pressures: Interest Rates, Tariffs & Stock Market Volatility

The slowdown in February were largely attributed to external economic pressures.

Concerns about the implementation of new tariffs contributed to uncertainty, leading some would-be buyers to hold back. While tariffs don’t directly target real estate, they influence luxury housing by increasing construction costs, shaking investor confidence, and potentially reducing foreign demand. The net impact depends on who the tariffs affect, how long they last, and what sectors (materials, manufacturing, trade) are hit hardest.

As a result, the stock market saw volatility, particularly in the tech and financial sectors, which also impacted affluent buyers’ decisions – many of whom derive their purchasing power from investment performance.

Though the interest rate environment remains more favorable than in recent years, rates are still higher than historic lows seen during the pandemic. These levels are still influencing sellers as well, particularly those who locked in ultra-low rates and are now reluctant to re-enter the market at higher borrowing costs.

At the same time, the housing market continues to face structural challenges: land scarcity, underbuilding since 2008, and a national housing supply deficit are long-term factors that keep upward pressure on prices. While inventory has improved, it remains well below pre-pandemic norms, and new construction has not fully rebounded.

Is It a Good Time to Buy or Sell?

Whether to buy or sell in the current market depends heavily on individual financial positions and goals.

For buyers:

Particularly long-term homeowners or lifestyle-driven investors, this is a strong market. The rise in inventory offers more choice, and less competitive pressure than in the past means greater negotiation opportunities. Buyers who don’t rely heavily on financing, such as cash buyers or those with significant equity, are in an especially advantageous position. Additionally, economic uncertainty is prompting some investors to shift capital out of volatile financial markets and into tangible assets like real estate.

(Suggested Reading: Decoding Luxury Real Estate Trends: How to Read the Market Like a Pro)

This is not a speculator’s market. There is little expectation of rapid price appreciation in the short term, so buyers should view purchases as long-term lifestyle or investment decisions. Although those open to properties that need updates, or willing to renovate, could find an opportunity to see uptick in their property’s value.

For sellers:

The equation is more nuanced. Those with low-interest mortgages face a “golden handcuff” dilemma: selling means giving up a favorable rate and buying again at higher costs. Although refinancing once mortgage rates have fallen is always an option further down the road for U.S. buyers. However, sellers who don’t need to repurchase immediately, such as those downsizing, relocating, or liquidating second homes, may find strong buyer demand still exists, especially in well-located or move-in-ready luxury homes.

Owners of luxury income-producing properties might consider holding for a few more years. With rental markets strong and ongoing demand for high-end leases, waiting could lead to greater returns once the market stabilizes further and interest rates potentially ease again.

(Suggested Reading: Opportunity in Uncertainty: Guiding Buyers and Sellers with Market Data)

Market Variables to Watch

Looking forward, several key factors will shape market behavior:

- Additional interest rate cuts could re-energize both buyers and sellers, particularly those on the sidelines waiting for more favorable borrowing terms.

- Stock market fluctuations will continue to influence luxury buyers, whose investment portfolios often drive purchasing power.

- Tariff implementations and geopolitical uncertainty could either spur real estate investment (as a safe haven) or introduce further caution.

- Insurance limitations and rebuild restrictions, especially in disaster-prone regions like Florida and California, could skew marketability of certain homes.

- The long-term supply shortage remains unresolved, as new construction still hasn’t returned to pre-2008 levels, reinforcing long-term appreciation potential.

Bottom Line

If you’re a financially secure buyer with a long-term outlook, now is a favorable time to purchase, especially with more inventory and less bidding pressure. Sellers may need to weigh their next move carefully, but many can still take advantage of active buyer demand – particularly if they’re not planning to buy again immediately. While economic headwinds may slow momentum in the short term, the foundational elements of the luxury real estate market remain strong heading into the rest of 2025.

(Suggested Reading: Smart Strategies for the 2025 Real Estate Market)

We encourage you to listen to the full podcast to gain more insights:

STAY AHEAD WITH THE INSTITUTE

For more guidance on growing your luxury real estate practice and developing your skills when working with the affluent, learn more about The Institute’s Training Options.

Becoming a member of The Institute is a valuable investment in your future success as a luxury real estate professional. Access curated real estate tools and resources, advanced learning experiences, and connect with a network of successful real estate professionals throughout the United States and Canada.

View additional insights from The Institute